I grew up middle class. The kind of middle class where you took a family road trip once a year, had economy cars in the driveway, did activities like piano and gymnastics lessons for me and my sister, and lived in a regular house in the suburbs (without the white picket fence). We were also the kind of middle class that did cheaper activities—camping (before it got gentrified), always cooking at home (McDonalds was a treat if we got A’s on our report cards), fixing our own cars and mowing our own lawns, and using sliced white bread for our cheeseburgers and hot dogs instead of costlier buns. I didn’t know what a Brioche bun was until my mid-twenties!

Like many American middle-class families, our financial security was constantly threatened by minor upsets and, due to a lack of financial education and foundation, we were always one event away from disaster. It wasn’t necessarily anybody’s fault—the way you were taught to view money has a monumental impact on your financial perspective, and it’s nearly impossible to know what’s right and wrong when you don’t know what you don’t know. There were many things that were culturally normalized throughout generations of financial mismanagement that I did not realize were wrong until I was much older and began seriously learning about personal finance. The strategies are not immediately obvious, and the plethora of bad information out there doesn’t help anyone who is just starting out.

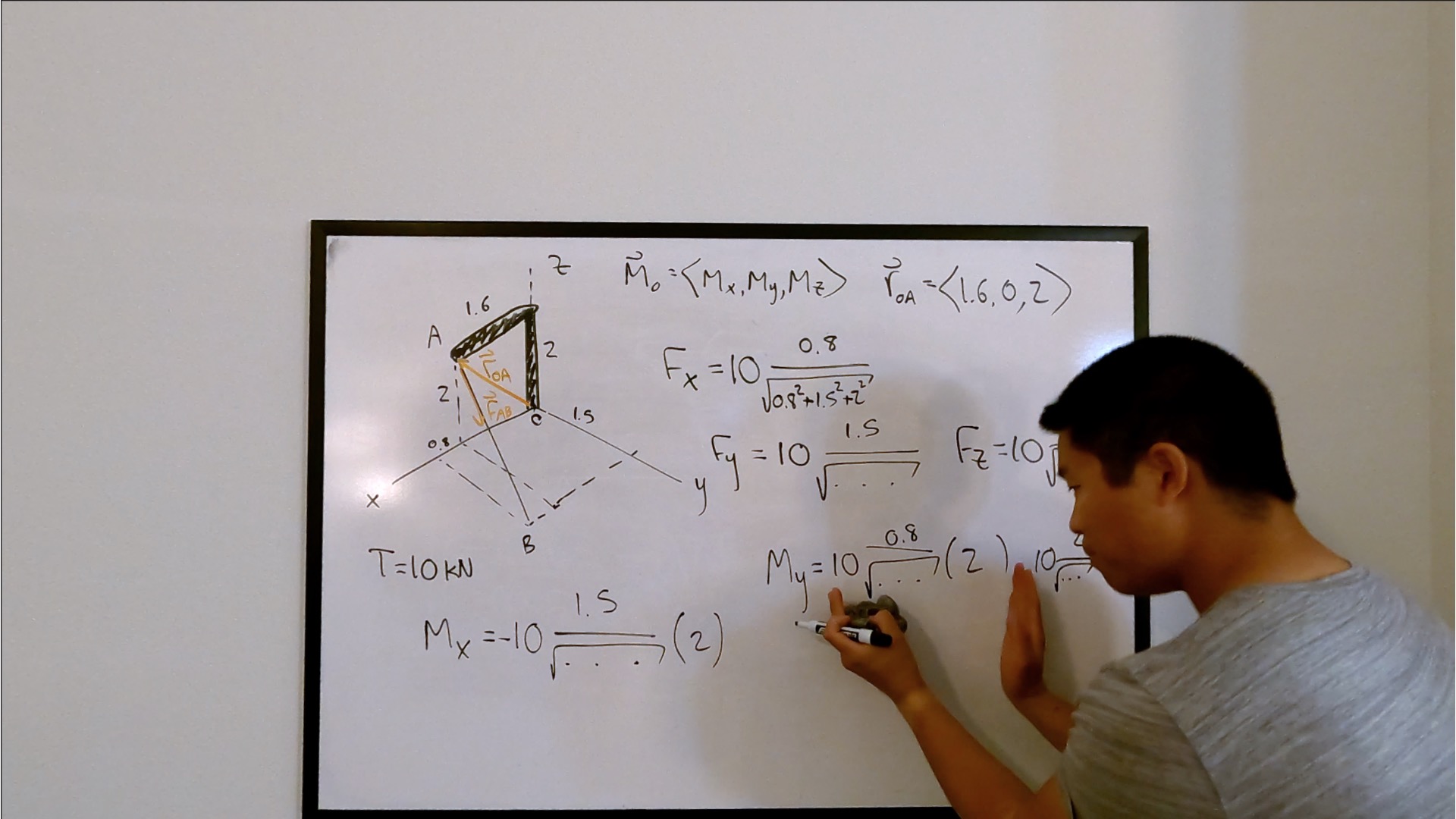

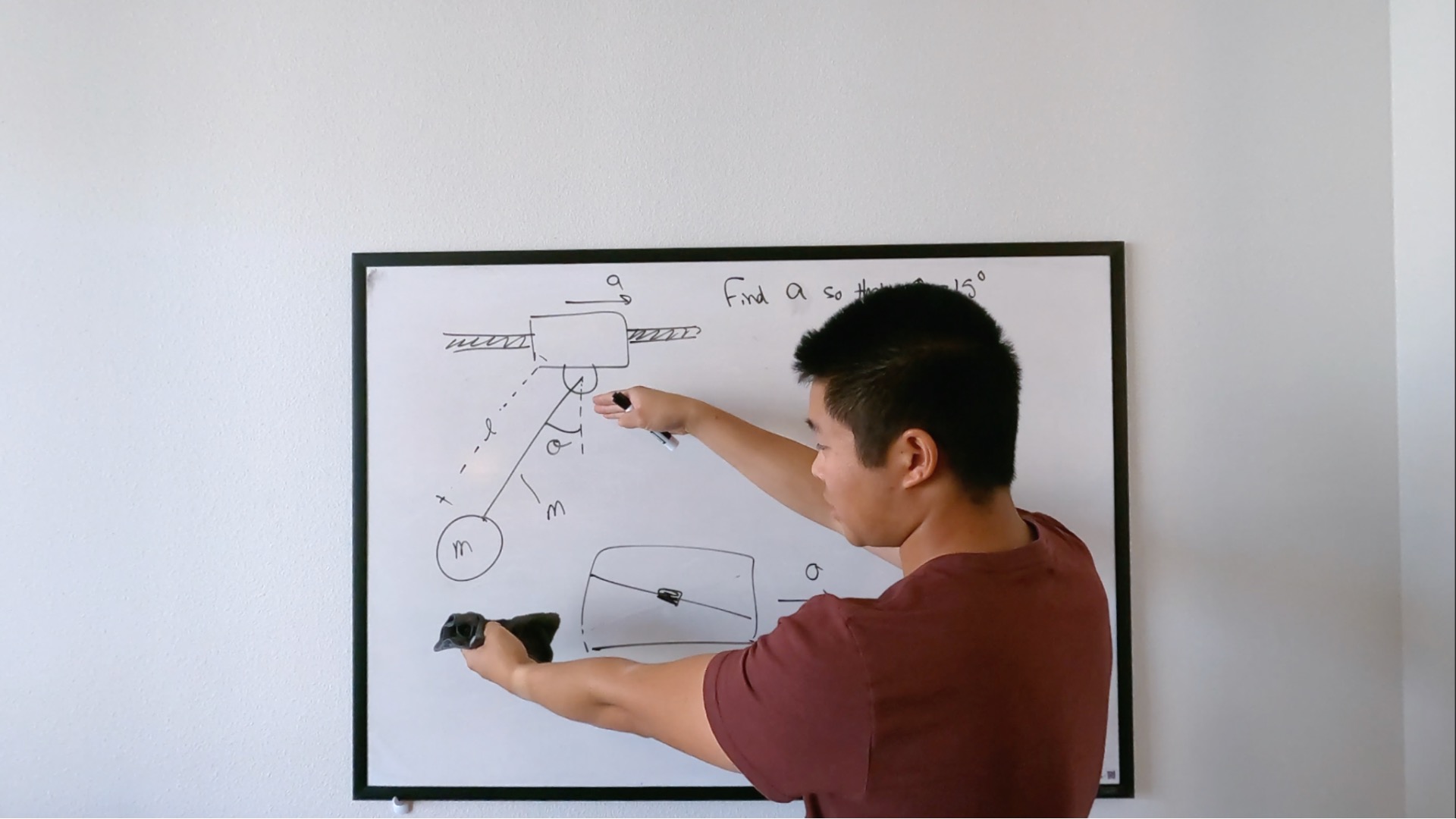

My background is in engineering. I hold Bachelor and Master of Science degrees in Mechanical Engineering from Virginia Tech, with a minor in Mathematics, and 5 years of industry experience. In addition, I have over 12 years of math tutoring experience with various applications, including financial mathematics and economics. I teach my students how to be first-principle thinkers and apply fundamental concepts to solve complicated real-life problems. Personal Finance for Young Professionals utilizes my ability to teach hard topics to people in ways they can understand. The technical aspects of this text are largely in keeping with received opinion in the industry, but are broken down into digestible, bite-sized pieces that can be easily understood by anyone with a background in basic high school math. One of the characteristics of a great tutor is being able to anticipate a question that a student might have before they ask it. Rather than info-dumping everything on the reader, I lean on my tutoring skills to systematically predict and proactively address questions that young professionals might have when starting their financial journey.

After entering the real world and earning my first paycheck, I realized that I would need to learn how to manage my money on my own. I did not want to rely on someone else to do that for the rest of my life. What if that person retires or isn’t around anymore? What if they don’t understand my financial needs as well as I do or what if those needs shift over time? Most importantly, it costs money to have someone manage your finances—way more money than you think. Through a combination of focused research, daily immersion in personal finance content, conversations with other finance nerds like myself, and good ol’ trial and error, I not only learned about tools and strategies that can be used to take control of and be successful with your finances, but also learned about the psychology required to understand your relationship with money and the relevant decisions you make. The resources that I used and those that I developed myself (spreadsheets, tools, etc.) are listed on this website for everyone to use.

I have spent years discussing finance with colleagues, friends, and family. I am constantly being asked questions about what to do, how to do it, and when to do it. As a result, I decided to dedicate time and energy to putting together a comprehensive book that any young professional can use to get their footing in personal finance.

Just like how past market performance does not guarantee future market performance, your past does not determine your future.

Are there times when my inherent frugality interferes with my quality of life? Yes! In those instances, I do my best to refer back to the rules that I set for myself so that I allow the money that I work hard for to go towards improving my life and providing me with happiness.

Nonetheless, I am greatly fulfilled by my hobbies! Spending an entire weekend building a piece of furniture is almost never worth it financially (although I once made a replica of a West Elm console table and saved $500), but there is an immense feeling of satisfaction in doing something yourself that is hard to achieve in today’s time.

I never feel that my hobbies are lacking, and when there is a need for a significant investment like new golf clubs or a new guitar amp, I throw it in the budget and it usually works out!

Jack of all trades, master of none!

For leisure, I have a variety of hobbies like cooking different foods and trying new restaurants, camping and fishing, playing golf, doing DIY projects around the house and on my car, playing guitar and piano, growing plants, and taking care of my outdoor cats.

In hindsight, many of my hobbies stem from frugality: building furniture instead of buying it, doing my own vehicle maintenance instead of taking it to a shop, learning how to make great coffee and espresso at home, and learning to cook fancy dishes instead of going out.

My other hobbies are relatively inexpensive, like gardening, fishing, and camping. As always, the sky is the limit with any hobby, but I tend to take it easy. The hobbies that tend to be more expensive like golf, I “frugalize” by walking instead of renting a cart (got to get my steps in) and playing twilight tee times for a discount.

Now is the time to take action. It is only a matter of time before now becomes forever. -Scott Gong